It’s that time again—another election cycle is upon us, and as usual, the political landscape is filled with confusion, exaggerations, and half-truths, particularly when it comes to the economy. As seasoned “Mustachians,” we know better than to get swept up in the partisan frenzy. While we vote and stay informed, we keep our focus on what truly matters: our own finances and the things we can control. But when politicians start muddying the waters with misinformation about money, the economy, and our collective wealth, it’s time to set the record straight.

Here are six common economic myths politicians like to spread—and why they’re simply not true.

1. The Economy is in Bad Shape—Despite All Evidence to the Contrary

This is perhaps the most egregious myth of all. If you’ve been following the news, you may have heard politicians claiming that the economy is in dire straits. Recently, we saw one side accusing the other of ruining the economy, with the usual refrain that “things are bad.” But here’s the inconvenient truth: the U.S. economy is stronger than it has ever been. We’re seeing historically low unemployment rates, a booming stock market, and growing wages in many sectors. Even the recent uptick in inflation is more a sign of an economy that’s too strong, prompting the Federal Reserve to raise interest rates as a way of cooling things down.

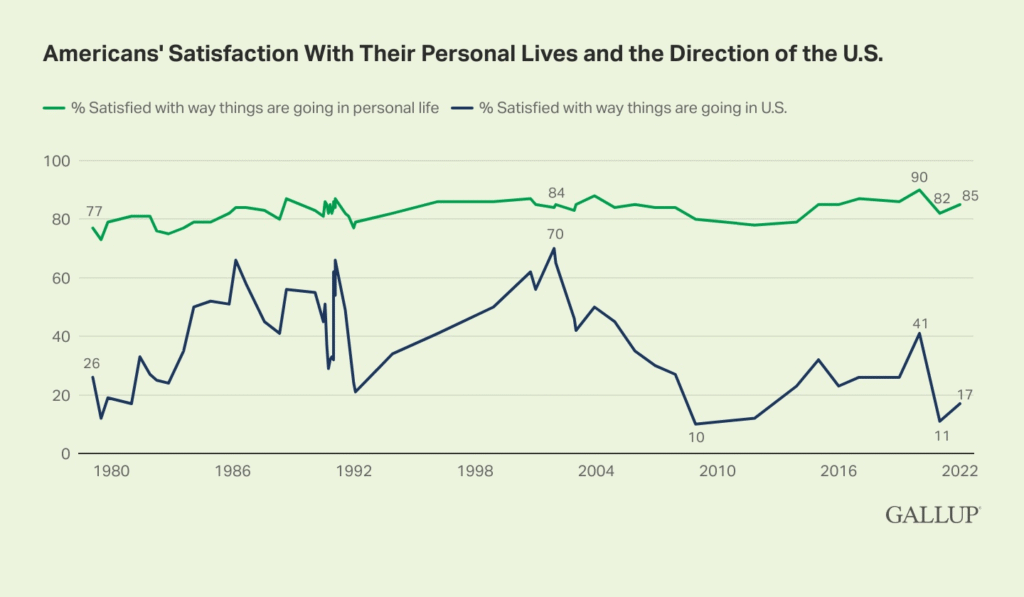

Yet, in polls like those from Gallup, most people—despite experiencing personal economic growth—think the economy is floundering. In fact, 85% of Americans report doing well financially, yet only 17% believe the economy is doing well. This is a mathematical contradiction. If most people are thriving, then logically, the economy itself must be in good shape. But somehow, misinformation from politicians and the media has clouded this simple truth.

2. Higher Taxes Are Always Bad for the Economy

It’s a familiar line that’s often trotted out during election years: politicians claiming that raising taxes will “crush the economy.” While it’s easy to see why that’s an appealing narrative, it’s not entirely accurate. The truth is, taxes are a necessary part of a functioning society. They fund infrastructure, education, healthcare, and all the services that contribute to a thriving economy.

In fact, studies have shown that properly structured taxes—particularly those on higher-income earners—can help to reduce inequality and stimulate economic growth. The key is how the tax revenue is spent. If it’s reinvested into the economy in ways that promote productivity and well-being, the overall economy can benefit in the long run. So, while no one enjoys paying taxes, they aren’t inherently bad for the economy if used effectively.

3. Jobs Are the Only Indicator of Economic Health

Politicians often love to focus on job numbers as the primary measure of a nation’s economic health. And while job creation is undeniably important, it’s not the full picture. Jobs are a result of a healthy economy, but they don’t tell us everything about the economy’s quality. Consider the rise of gig work and automation—two major trends that may provide jobs but don’t necessarily equate to higher living standards or long-term stability for workers.

The real measure of economic health should include factors like wage growth, income equality, productivity, and the sustainability of job creation. After all, a low unemployment rate can be misleading if it’s paired with stagnant wages or underemployment. So, while jobs are important, they don’t tell us the whole story.

4. Big Businesses Create Most Jobs

There’s a widespread belief that large corporations are the primary drivers of job creation, but this simply isn’t true. In reality, small businesses account for the vast majority of new jobs in the economy. According to data from the U.S. Small Business Administration, small businesses create about 64% of new jobs annually.

Politicians and big business lobbies often exaggerate the importance of giant corporations when, in reality, the economy thrives on entrepreneurship and small businesses. Supporting these small businesses through favorable policies and access to capital can lead to more sustainable job creation and a healthier economy overall.

5. Government Debt is Always a Bad Thing

Another myth that’s commonly tossed around during election years is the idea that government debt is inherently disastrous. While it’s true that excessive debt can lead to problems, it’s important to remember that government debt, like personal debt, is not always bad. The key lies in how that debt is managed and invested.

In fact, borrowing to invest in infrastructure, education, and other long-term growth initiatives can yield a significant return on investment. A government that borrows to fund productive ventures may actually enhance its economy, just as a business or individual might borrow to make investments that lead to greater wealth down the road. The key is to ensure that the debt is used wisely, and the benefits outweigh the costs.

6. Trade Deficits Are Always Harmful

Politicians love to harp on the idea of trade deficits, with many claiming that a country running a deficit is somehow weakening itself. While trade deficits can signal underlying economic imbalances, they are not inherently harmful. In fact, trade deficits are often a natural outcome of a growing economy.

When a country’s economy is strong, it tends to import more goods, often because domestic demand is high. This doesn’t necessarily mean the economy is in trouble—it can simply reflect the fact that people are purchasing more goods and services from abroad. Moreover, trade deficits are often offset by investments in the domestic economy that lead to higher productivity and wealth. So, while it’s important to monitor trade balances, a deficit alone is not a reason to panic.

Conclusion: Empower Yourself with Economic Truths

In today’s political climate, it’s easy to get lost in the noise and confusion surrounding economic issues. Politicians will continue to peddle myths and half-truths to sway voters and score points, but the truth is that the U.S. economy is much more complex and resilient than these oversimplifications suggest.

By learning to recognize these misconceptions and understanding how the economy truly works, you can better navigate the political rhetoric and make more informed decisions. After all, understanding the economy is not just about staying politically savvy—it’s also about securing your financial future. Knowledge is power, and in the case of economics, it’s also wealth.