At first glance, today’s stock market seems like a financial high-wire act. Prices are elevated, headlines are euphoric, and many investors are wondering if we’re in a bubble. But dig a little deeper, and the picture becomes more nuanced. The market’s not just riding high on blind optimism — it’s also riding on expectations of future growth, especially in a few dominant companies.

So how do we make sense of it all? Let’s return to a familiar analogy: the trusty rental property.

Paying Today for Tomorrow’s Rent

Imagine you’re considering buying a rental house. Based on current rent prices, the deal feels a bit steep. But there’s a twist — a major new Apple campus is under construction nearby, and you reasonably expect that this will push up local rents for years to come. Suddenly, paying a premium today seems smarter, because you’re factoring in tomorrow’s income.

This is the same logic that drives the price of a stock. Investors aren’t just paying for what a company is earning right now — they’re making a judgment about what it might earn in the future.

Take Peloton, for example. During the pandemic, it experienced a sudden surge in demand as people scrambled to replicate gym workouts at home. Investors jumped on the bandwagon, assuming this boom would continue indefinitely. Share prices skyrocketed. But as life normalized, demand tapered off and the stock returned to earth. The market had priced in growth that didn’t stick.

Now, what happens when this kind of optimism doesn’t apply to just one company, but the entire stock market?

The Market’s Current Surge: A Closer Look

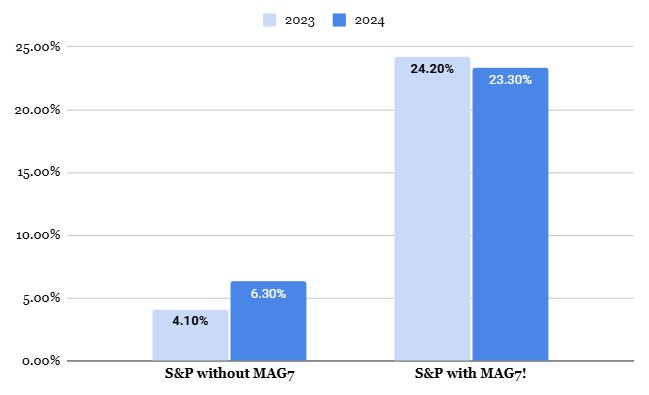

On the surface, the S&P 500 — a broad index representing the 500 largest publicly traded U.S. companies — has soared. But that doesn’t mean every company is booming. In fact, about 75% of the recent market gains can be traced back to just seven companies: Apple, Nvidia, Microsoft, Amazon, Google (Alphabet), Facebook (Meta), and sometimes Tesla. Collectively, these companies have earned the nickname “The Magnificent Seven.”

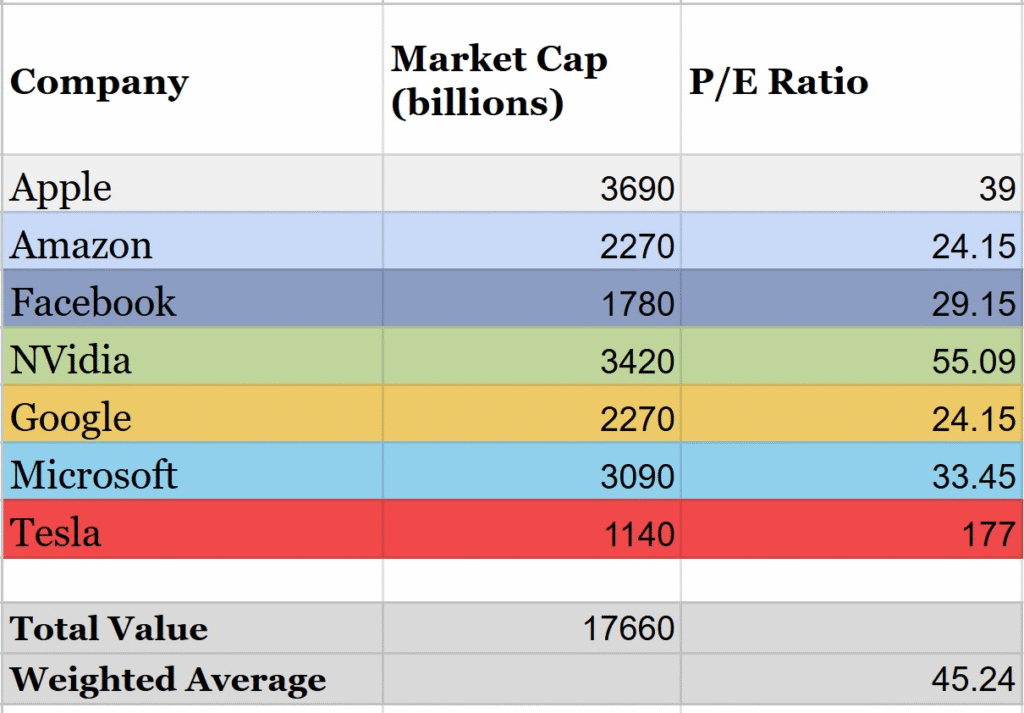

These tech giants are not just large — they’re massive. Together, they now account for over 25% of the entire market’s value, totaling an eye-watering $17.66 trillion. Investors see these companies as the engines of future growth, especially in areas like artificial intelligence, cloud computing, and advanced hardware.

Because of that, their stock prices have risen sharply — and so have their valuations. The average price-to-earnings (P/E) ratio among these seven companies hovers around 45, which is very high by historical standards.

Tesla, in particular, trades at a premium that reflects enormous expectations for future earnings, even though its current profits don’t justify that valuation on a traditional basis.

What About the Rest of the Market?

If we strip out the Magnificent Seven from the S&P 500, we’re left with the other 493 companies. And here’s the surprising part: the average P/E ratio of this remaining group is just 20 — much closer to historical norms and arguably within a reasonable range.

This tells us something important: the broader market isn’t in a uniform frenzy. The elevated index values are largely the result of investor enthusiasm toward a small cluster of dominant companies, not a sweeping mania across all sectors.

In other words, the “bubble,” if there is one, is not evenly distributed.

What Does This Mean for Future Returns?

This market dynamic — where a few companies carry the bulk of the market’s momentum — brings both opportunity and risk.

If the Magnificent Seven continue to innovate and grow, their lofty valuations might eventually be justified. Think of them as those rental homes in booming neighborhoods — expensive today, but likely to produce more rent down the line.

But if their earnings don’t keep pace with expectations, those high valuations could come crashing down. And because these companies represent such a large chunk of the index, a stumble from just a few of them could drag down the whole market’s performance.

Meanwhile, the rest of the market may be less glamorous, but potentially more stable. Companies with moderate P/E ratios could deliver more reliable returns over time, especially if growth resumes more broadly across the economy.

The Takeaway: Don’t Fall for the Headlines

The next time you hear that “the market is in a bubble,” remember this: it’s not a simple yes or no answer. The market is made up of hundreds of businesses, each with its own story. Some are trading on current profits. Others are riding the wave of future expectations. And only a few — albeit very large ones — are distorting the whole picture.

If you’re a long-term investor, the message is clear: diversify, understand what you’re buying, and don’t let short-term hype cloud your judgment. Owning stocks isn’t about predicting the next AI breakthrough — it’s about patiently participating in the productivity and earnings of real businesses over time.

Yes, parts of the market may be frothy. But parts are also reasonably valued. The challenge is keeping your focus steady and your strategy grounded.

Because in the end, whether you’re investing in a rental house or a high-flying tech stock, the same truth applies: real returns come from real earnings — not just rosy forecasts.